Bioethanol, which is a type of renewable fuel that can be used as an alternative to gasoline, has a significant impact on the world’s energy and economic sectors. With the push for carbon neutrality and reduced dependence on fossil fuels, the bioethanol industry has become a pivotal player.

Countries worldwide are recalibrating their energy portfolios, and businesses engaged in 1G bioethanol production find themselves strategically positioned at the intersection of environmental responsibility and economic opportunity. This post gives an insight into the current and future potential of Bioethanol in India. The bioethanol market in India is rapidly evolving, driven by the government’s emphasis on renewable energy and reduced dependence on fossil fuels.Investment in India’s bioethanol production is increasing, with the industry showcasing significant potential for profits and returns.

Key Questions on the Indian Bioethanol Market:

- What is the estimated market size of the Indian bioethanol 1G market by 2027?

- What is the projected Compound Annual Growth Rate (CAGR) for the Indian bioethanol market from 2023 to 2027?

- How does the Indian government’s ethanol blending mandate influence the demand for bioethanol?

- What is India’s current installed capacity for bioethanol production, and how much of it is utilized?

- What are the future projections for India’s bioethanol market size by 2030?

- Which non-molasses feedstocks are being considered for bioethanol production in India?

- How is the Indian government supporting the establishment of second-generation (2G) ethanol plants?

- What potential export markets exist for India’s bioethanol industry in Asia and Africa?

- Who are some of the key companies involved in bioethanol production in India?

- What role do raw materials play in India’s bioethanol supply chain?

- Which companies are leading the bioethanol market in India?

- What new technologies are being introduced for bioethanol production in India?

- How much does it cost to set up a bioethanol production facility in India?

- What is the future growth potential of the bioethanol market in India?

- How is bioethanol being used in India, especially in the transportation sector?

- How is bioethanol produced from agricultural feedstocks like sugarcane and maize?

- Which states in India are adopting bioethanol production and usage the most?

- What is the current price of bioethanol in India, and how does it fluctuate with feedstock supply and demand?

- What are the main challenges faced by the bioethanol industry in India, particularly related to feedstock supply, infrastructure, and distribution?

- What are the key business opportunities for small, medium, and large industries in the bioethanol sector in India?

- What innovations in bioethanol production technologies are expected to reduce costs and improve efficiency?

- What government policies, incentives, or subsidies are available to support bioethanol producers in India?

- How does bioethanol compare to other alternative fuels like compressed biogas (CBG) and biodiesel in terms of environmental impact, cost, and scalability?

- What are the niche opportunities for specialized players within India’s bioethanol market, such as small-scale producers or new technology developers?

Market Potential of India

Market Size and Growth

- The Indian bioethanol 1G market is estimated to reach USD 5.2 billion by 2027, growing at a CAGR of 13.4% from 2023 to 2027.

- The Indian bioethanol market is experiencing a steady Compound Annual Growth Rate (CAGR), reflecting the growing adoption of biofuels across industries.With enhanced production capacity, the bioethanol industry is catering to the rising demand for eco-friendly alternatives in energy and transportation sectors.Government policies on bioethanol have been pivotal in promoting its integration into the energy mix, especially with the National Bio-Energy Mission.

Demand Drivers

- Ethanol Blending Mandate (EBP): The government’s ambitious target of 20% ethanol blending in gasoline by 2025 is the primary driver of market growth. This policy is expected to create a demand for an additional 5.0 billion liters of bioethanol by 2025.

- Rising Fuel Demand: India’s growing population and rapid urbanization are expected to drive a 3.5% CAGR in gasoline demand by 2025. Bioethanol can partially address this demand while promoting energy security.

Production Capacity

- India’s current installed capacity for bioethanol production is around 6.3 billion liters per annum (BLPA). However, only around 3.5 BLPA is utilized, highlighting significant growth potential.

Future Potential

- The market size is expected to reach 15 billion liters by 2030.

- Focus on non-molasses feedstocks like corn, grain, and cellulosic biomass.

- Government support for setting up second-generation (2G) ethanol plants.

- Potential for export markets in Asia and Africa.

- Government policies on bioethanol blending mandates have significantly boosted demand, with targets such as achieving 20% ethanol blending by 2030.

- Subsidies and incentives for bioethanol production are fostering investments and encouraging private players to enter the market.

Bioethanol Sector Companies in India (Examples)

| Category | Company Name | Role(s) |

| Producers | Balrampur Chini Mills Ltd. | Integrated sugar & bioethanol producer, owns mills, distilleries, bioethanol plants |

| DCM Shriram Industries Ltd. | Sugar mills, distilleries, bioethanol production units | |

| Praj Industries Ltd. | Manufacturer, technology solution provider, offers equipment, end-to-end project solutions, in-house technology development | |

| Indian Glycols Limited (IGL) | Bioethanol producer focuses on bio-based chemicals, explores new product applications | |

| Triveni Engineering & Industries Ltd. | Leading sugar producer with substantial bioethanol production capacity | |

| Raw Material Suppliers | Sugar Mills Nationwide | Primary suppliers of sugarcane molasses (e.g., Upper Ganges Sugar Mills Ltd., Mawana Sugars Ltd.) |

| Grain Merchants & Traders | Suppliers of starchy feedstocks (maize, broken rice) (e.g., Punjab Agri Products Ltd., Krishnamurti Rice Mill) | |

| Agricultural Residue Aggregators | Focus on cellulosic biomass (e.g., Ecofibre India Pvt. Ltd., Carbon Masters India Pvt. Ltd.) | |

| State-Owned Trading Corporations | Facilitate and manage raw material procurement (e.g., NAFED) | |

| Contract Farming Initiatives | Producers & technology providers like Praj Industries engage in contract farming for dedicated feedstock production | |

| Manufacturers (Equipment) | Praj Industries Ltd. | Fermentation, distillation, dehydration systems, other bioethanol plant equipment |

| Alfa Laval India Pvt. Ltd. | Process equipment (heat exchangers, separators) | |

| Larsen & Toubro (L&T) Ltd. | Heavy engineering expertise for bioethanol plant construction | |

| Thermax Ltd. | Boilers, heat exchangers, and other process equipment | |

| Bhadra Engineering Works Ltd. | Sugar & distillery machinery also supplies equipment for bioethanol production | |

| Technology Solution Providers | Praj Industries Ltd. | In-house technologies, end-to-end project solutions, equipment manufacturing |

| Novozymes India Pvt. Ltd. | Advanced enzymes for starch hydrolysis & fermentation | |

| DuPont India Pvt. Ltd. | Advanced yeast strains, process optimization solutions | |

| Enzyme Industries Ltd. (EIL) | Industrial enzymes, including those for bioethanol production | |

| Bioprocess Technology Group (BTG) – IIT Delhi | Research group focusing on advanced bioethanol production technologies |

Technical Details of 1G Ethanol Production in India

Raw Materials

Molasses: The primary feedstock, containing readily available fermentable sugars (sucrose, glucose, fructose). It’s a byproduct of sugarcane processing and comes in various types (A, B, and C) with differing sugar content and impurities.

Starch-based feedstocks:

Gaining traction due to government incentives.

Expert Consulting Assistance for Indian Bioenergy & Biomaterials

Talk to BioBiz

Call Muthu – 9952910083

Email – ask@biobiz.in

- Corn: High starch content, requires milling and enzyme conversion.

- Grain: Similar to corn, with diverse options like wheat, rice, and damaged/surplus food grains.

- Other: Cassava, potatoes, etc., with varying processing needs.

Enzymes

- Alpha-amylase: Breaks down starch into dextrins (complex sugars).

- Glucoamylase: Converts dextrins into fermentable sugars like glucose.

- Cellulase enzymes (for future 2G ethanol): Decompose cellulose from non-food biomass into fermentable sugars.

Production processes

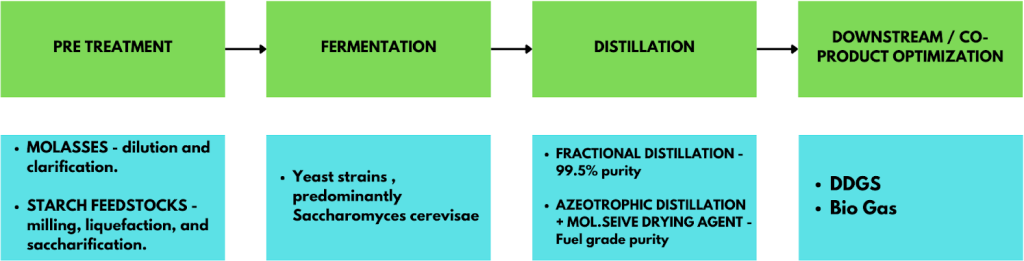

The production of bioethanol involves a multi-stage process aimed at converting raw materials into a sustainable fuel source. This intricate process is marked by distinct phases, each playing a crucial role in ensuring the quality and efficiency of the final product.

- Pretreatment: In the initial stage, known as Pretreatment, molasses undergoes dilution and clarification to eliminate impurities, setting the stage for a pristine fermentation process. Simultaneously, starch-based feedstocks follow a path involving milling, liquefaction, and saccharification, culminating in the conversion of complex starches into fermentable sugars.

- Liquefaction: Uses alpha-amylase to convert starch to dextrins at high temperatures (60-100°C).

- Saccharification: Uses glucoamylase to break down dextrins into fermentable sugars at lower temperatures (40-50°C).

- Fermentation: The heart of the bioethanol production process lies in the Fermentation stage. Utilizing yeast strains, predominantly Saccharomyces cerevisiae, this phase orchestrates the conversion of sugars into ethanol and carbon dioxide. Stringent control of temperature and pH is imperative to maximize the efficiency of the fermentation process.

- Controlled temperature (28-32°C) and pH (4.5-5.0) are crucial for efficient fermentation.

- Large fermentation tanks (20,000-100,000 liters) made of stainless steel or concrete are used.

- Distillation: Post-fermentation, the Distillation stage takes center stage. Employing fractional distillation, ethanol is separated from the fermented broth, achieving the desired purity level of 99.5%. Azeotropic distillation, supplemented by a molecular sieve drying agent, ensures the production of fuel-grade ethanol.

- Co-Products: Integral to the bioethanol production process are co-products that contribute to overall sustainability. Biogas, a byproduct of fermentation, can be harnessed for energy generation or utilized in other industrial processes. Additionally, Dried Distillers Grains with Solubles (DDGS) emerge as a valuable high-protein animal feed.

Technical Details of 2G Ethanol Production in India

Raw Materials

Lignocellulosic Biomass: This is the primary feedstock for 2G ethanol production, comprising agricultural and forestry residues, and dedicated energy crops.

- Agricultural Residues: Rice straw, wheat straw, corn stover, and sugarcane bagasse are among the most abundant and readily available residues.

- Forestry Residues: Sawdust, woody residues, and bamboo have significant potential, especially in regions with extensive forest cover or bamboo cultivation.

- Energy Crops: Dedicated crops like Napier grass, sweet sorghum, and jatropha provide additional biomass for ethanol production.

Enzymes

- Cellulase Enzymes: Essential for breaking down cellulose and hemicellulose into fermentable sugars.

- Hemicellulase: Breaks down hemicellulose into simpler sugars such as xylose.

- Lignin-degrading Enzymes: Aid in breaking down lignin to facilitate the access of cellulase and hemicellulase to cellulose and hemicellulose.

Production Processes

The production of 2G ethanol involves a more complex process compared to 1G ethanol, focusing on the efficient conversion of lignocellulosic biomass into fermentable sugars and then into ethanol. This multi-stage process includes

- Pretreatment: This crucial stage involves breaking down the complex structure of lignocellulosic biomass to make cellulose and hemicellulose accessible to enzymes. Methods include

- Physical Pretreatment: Milling or grinding to reduce particle size.

- Chemical Pretreatment: Use of acids or alkalis to break down lignin and hemicellulose.

- Physicochemical Pretreatment: Steam explosion or hydrothermal processing to disrupt the biomass structure.

- Biological Pretreatment: Using microorganisms to degrade lignin.

- Hydrolysis: The pretreated biomass undergoes enzymatic hydrolysis to convert cellulose and hemicellulose into fermentable sugars.

- Enzymatic Hydrolysis: Involves cellulase and hemicellulase enzymes to break down cellulose and hemicellulose into glucose, xylose, and other fermentable sugars.

- Conditions: Typically conducted at temperatures of 45-50°C and pH 4.8-5.0.

- Fermentation: The hydrolyzed sugars are then fermented into ethanol using specialized microorganisms.

- Microorganisms: Yeast strains such as Saccharomyces cerevisiae or genetically engineered bacteria capable of fermenting both hexoses (glucose) and pentoses (xylose).

- Conditions: Controlled temperature (30-37°C) and pH (4.5-5.5) for optimal fermentation efficiency.

- Distillation: Similar to 1G ethanol production, the fermented broth undergoes distillation to purify ethanol to the desired concentration.

- Fractional Distillation: Separates ethanol from water and other impurities.

- Azeotropic Distillation: Uses additional techniques like molecular sieve dehydration to achieve fuel-grade ethanol purity.

- Co-Products: 2G ethanol production generates several valuable co-products that enhance the overall sustainability of the process.

- Lignin: Can be used for heat and power generation or as a raw material for producing chemicals and materials.

- Biogas: Produced from the anaerobic digestion of fermentation residues, can be used for energy generation.

- Animal Feed: Similar to 1G ethanol, dried distiller grains (DDGS) can be used as a high-protein animal feed.

Feedstock availability

Top 10 States in India with High Feedstock Availability for Bioethanol Production (Million Tonnes per Year)

| Rank | State | Sugarcane Production (MTY) | Molasses Availability (Estimated) (MTY) |

| 1 | Uttar Pradesh | 432.00 | 17.28 |

| 2 | Maharashtra | 368.00 | 14.72 |

| 3 | Karnataka | 238.00 | 9.52 |

| 4 | Tamil Nadu | 189.00 | 7.56 |

| 5 | Bihar | 175.00 | 7.00 |

| 6 | Punjab | 107.00 | 4.28 |

| 7 | Gujarat | 104.00 | 4.16 |

| 8 | Haryana | 98.00 | 3.92 |

| 9 | Andhra Pradesh | 89.00 | 3.56 |

| 10 | Telangana | 85.00 | 3.40 |

- Sugarcane is one of the most popular crops being produced in India and more or less 5 million hectares of land is being utilized only for its production. Traditionally, sugar is the feedstock used in the production of Bioethanol.

- Primarily molasses is the feedstock (a byproduct of sugarcane processing) due to its readily available fermentable sugars.

- Starch-based feedstocks like corn, grain, and damaged food grains (not competing with food sources) are gaining traction with government incentives.

State-wise Analysis of Bioethanol Production in India

| State | Primary Feedstock | Emerging and Potential Feedstocks | Collection & Transportation Infrastructure | Government Initiatives |

| Uttar Pradesh | Sugarcane molasses | Rice straw, wheat straw | Developing | Ethanol blending program, financial assistance for bioethanol projects |

| Maharashtra | Sugarcane molasses | Sorghum, rice straw, bagasse | Relatively developed | State biofuel policy, focus on cellulosic ethanol production |

| Karnataka | Sugarcane molasses | Rice straw, bagasse, cassava | Developing | K-Biofuel Development Corporation promotes research and development |

| Tamil Nadu | Sugarcane molasses | Rice straw, bagasse | Moderately developed | Bioethanol blending mandate, subsidies for setting up bioethanol plants |

| Bihar | Sugarcane molasses, broken rice | Maize, rice straw | Limited development | Focus on promoting maize cultivation for bioethanol, biofuel policy under development |

| Punjab | Sugarcane molasses, damaged food grains | Rice straw, wheat straw | Moderately developed | Punjab Bioethanol Policy promotes setting up bioethanol plants using various feedstocks |

| Haryana | Sugarcane molasses, damaged food grains | Wheat straw, rice straw | Moderately developed | Haryana Biofuel Development Policy focuses on diversification of feedstocks |

| Andhra Pradesh | Sugarcane molasses, broken rice | Maize, rice straw, sorghum | Developing | State Biofuel Policy promotes setting up 2G bioethanol plants |

| Telangana | Sugarcane molasses, broken rice | Maize, rice straw, sorghum | Limited development | Mission for Acceleration of Development of Biofuels in Telangana (MAD-Bio) |

| Gujarat | Sugarcane molasses | Cotton stalks, other agricultural residues | Moderately developed | Gujarat Biofuel Policy promotes setting up bioethanol plants and research in cellulosic ethanol |

| Madhya Pradesh | Sugarcane molasses (limited) | Rice straw, wheat straw, dedicated energy crops | Limited development | Bioethanol blending mandate, focus on promoting bioethanol production from non-food feedstocks |

| Odisha | Sugarcane molasses (limited) | Rice straw, dedicated energy crops | Limited development | Odisha Biofuel Development Policy encourages setting up bioethanol plants |

| Rajasthan | Sugarcane molasses (limited) | Sorghum, wheat straw | Limited development | Rajasthan Biofuel Policy promotes research and development in biofuels |

| Chhattisgarh | Sugarcane molasses (limited) | Rice straw, dedicated energy crops | Limited development | Chhattisgarh Biofuel Policy focuses on promoting sustainable biofuel production |

| West Bengal | Sugarcane molasses (limited) | Rice straw, jute stalks | Limited development | West Bengal Biofuel Development Policy, promotes setting up biorefineries |

Types of Feedstocks for Bioethanol Production in India

| Category | Feedstock Examples | Advantages | Disadvantages | Current Status in India |

| 1. First-Generation Feedstocks | Sugarcane molasses | Readily available from the existing sugar industry. Established conversion technology. | Competes with sugar production for land and resources. High water footprint. | Dominant feedstock is used extensively. |

| Sugarcane juice (limited) | High sugar content, potentially high ethanol yield. | Competes directly with sugar production for food and industrial uses. | Limited use due to competition, primarily in surplus sugarcane regions. | |

| Sugar beet (limited) | High sugar content, good cold tolerance. | Requires specific climate and soil conditions, and limited cultivation area. | Limited use, primarily in northern states with suitable conditions. | |

| Damaged food grains (rice, corn, wheat) | Readily available in times of surplus or spoilage. | Unreliable supply competes with food security needs. | Limited and sporadic use due to concerns about food security. | |

| Sorghum | Drought-resistant grows in diverse conditions. | Lower yield compared to sugarcane. | Gaining attention as an alternative, research, and pilot projects are ongoing. | |

| 2. Second-Generation (Cellulosic) Feedstocks | Agricultural residues (rice/wheat straw, corn stover, bagasse) | Abundant and often underutilized. Contributes to waste reduction and circular economy. | Requires advanced conversion technologies, currently more expensive than first-generation. Bulky and challenging to collect and transport efficiently. | Increasing focus, research, and pilot projects are underway. Government incentives for utilization. |

| Forestry residues (wood chips, sawdust) | Potentially abundant source, especially in regions with forestry activities. | Requires careful management to avoid unsustainable practices. Logistics and potential environmental concerns need to be addressed. | Limited use, potential for expansion with responsible sourcing practices. | |

| Energy crops (bamboo, perennial grasses) | Dedicated crops are grown specifically for biofuel production. Can offer high yields and potential environmental benefits like carbon sequestration. | Requires dedicated land, potential competition with food production, or land use change. Research and development are ongoing, not yet commercially viable at scale. | Emerging option, long-term potential with responsible land use planning. | |

| 3. Other Potential Feedstocks | Algal Biomass: | High potential for efficient biomass production. Can be cultivated on non-arable land. | Requires significant research and development to improve cost-effectiveness and scalability. Not yet commercially viable. | Early research stage, significant challenges to overcome. |

| Industrial Wastes (organic waste streams): | Contributes to waste management and resource recovery. | Requires efficient collection and pre-processing of diverse waste streams. Conversion technologies may need adaptation for specific waste characteristics. | Limited use, pilot projects exploring potential. |

Emerging feedstocks for Bioethanol

1. Lignocellulosic Biomass: India has a vast and diverse range of agricultural and forestry residues that can serve as potential feedstocks for bioethanol.

- Agricultural Residues: Rice straw, wheat straw, corn stover, and sugarcane bagasse are among the most abundant and readily available residues.

- Forestry Residues: Sawdust, woody residues, and bamboo have significant potential, especially in regions with extensive forest cover or bamboo cultivation.

- Energy Crops: India has suitable land for growing dedicated energy crops like Napier grass, sweet sorghum, and jatropha that can provide additional biomass for bioethanol production.

2. Algae: India’s long coastline and diverse aquatic environments create opportunities for both microalgae and macroalgae (seaweed) cultivation.

- Microalgae: Various species of microalgae thrive in Indian waters with a high potential for cultivation in both fresh and saltwater environments.

- Macroalgae (Seaweed): India has rich seaweed resources along its extensive coastline, with potential for large-scale production.

3. Cellulosic Waste: India generates substantial amounts of cellulosic waste with varying potential for bioethanol production.

- Municipal Solid Waste (MSW): Separating the organic and cellulosic fraction of MSW can provide a feedstock source.

- Paper and Pulp Mill Sludge: Waste from paper mills can be rich in cellulosic materials suitable for conversion.

4. Food Waste: India witnesses significant amounts of food waste throughout the supply chain. Utilizing food waste for bioethanol could offer both waste management and energy production benefits.

5. Invasive Plant Species

- Certain invasive plant species like Lantana camara (lantana) and Parthenium hysterophorus (parthenium) pose environmental and agricultural challenges. Research explores their potential as bioethanol feedstocks, offering a solution for managing these invasive species while generating renewable fuel.

6. Fallen Leaves and Tree Litter

- Fallen leaves and tree litter from urban and forest areas can be a source of lignocellulosic biomass. While logistical challenges exist, the research explores cost-effective methods for collection and pre-treatment to utilize this widespread resource.

7. Agricultural Wastewater

- Wastewater generated from agricultural activities, including food processing facilities, can contain organic matter suitable for conversion to bioethanol. This would offer a sustainable approach to waste management and resource recovery within the agricultural sector.

8. Manure and Biogas Digestate

- While challenges exist regarding competition with fertilizer use and potential nutrient loss, the research explores the feasibility of utilizing manure and digestate from biogas plants as feedstocks for bioethanol production. This could offer efficient utilization of organic waste streams while integrating with existing biogas infrastructure.

9. Biodiesel Byproducts

- Glycerol, a byproduct of biodiesel production, holds potential as a feedstock for bioethanol production. This approach could enhance resource utilization and create a more integrated biofuel production system.

New Technologies Revolutionising the Bioethanol Sector

The bioethanol sector is constantly evolving, driven by the need for sustainable and efficient fuel alternatives. Here are some exciting new technologies making waves.

1. Advanced Feedstock Conversion

- Consolidated Bioprocessing (CBP): This innovative process combines fermentation and hydrolysis into a single step, reducing costs and energy consumption.

- Consolidated Bioprocessing with Engineered Microorganisms: Modifying microbes to efficiently digest complex carbohydrates like cellulose opens up new feedstock possibilities like agricultural residues and woody biomass.

- Gas Fermentation: Converting industrial waste gases like carbon dioxide and syngas into ethanol offers a sustainable solution for waste management and biofuel production.

2. Enhanced Fermentation

- Engineered Yeast Strains: Modifying yeast strains to produce higher ethanol yields, tolerate stress conditions, and convert diverse sugars enhances efficiency and feedstock flexibility.

- Continuous Fermentation: Moving from batch to continuous fermentation processes allows for larger-scale production, reduces downtime, and optimizes resource utilization.

- Electro Fermentation: This technology uses electricity to drive fermentation, potentially leading to cleaner and more efficient ethanol production.

3. Next-Generation Feedstocks

- Cellulosic Ethanol: Technologies like ionic liquids and enzymatic hydrolysis are being developed to unlock the potential of lignocellulosic biomass, a more sustainable feedstock than traditional crops.

- Algae-based Ethanol: Growing algae for biofuel production offers advantages like high biomass yield and efficient land use.

- Municipal Solid Waste (MSW)–b Ethanol: Converting organic waste into ethanol can address waste management challenges and contribute to the circular economy.

4. Artificial Intelligence (AI) and Machine Learning (ML)

- Process Optimization: AI and ML are being used to optimize fermentation processes, predict yields, and minimize waste, leading to improved efficiency and profitability.

- Feedstock Selection and Sourcing: AI algorithms can analyze data to identify and optimize feedstock sources based on availability, cost, and sustainability factors.

- Predictive Maintenance: ML models can predict equipment failures and optimize maintenance schedules, reducing downtime and costs.

5. Blockchain Technology

- Supply Chain Transparency: Blockchain can track the origin and processing of feedstocks, ensuring ethical sourcing and sustainable practices.

- Traceability and Verification: This technology can verify the authenticity and sustainability of bioethanol products, enhancing consumer trust and market access.

Bioethanol Production Technologies in India: Development Stage by TRL Level

| TRL Level | Development Stage | Description | Examples in India |

| TRL 8-9 | Mature Technologies | Commercially available and widely used for bioethanol production. | 1st generation bioethanol from sugarcane molasses |

| TRL 7 | Advanced Demonstration | Demonstrated in pilot or commercial-scale operations, nearing wider adoption. | 2nd generation bioethanol from lignocellulosic biomass (cellulose, hemicellulose) |

| TRL 5-6 | Validation Stage | Processes and technologies validated in lab or pilot-scale, progressing towards demonstration and commercialization. | Enzymatic hydrolysis pre-treatment for 2nd generation bioethanol, Consolidated Bioprocessing (CBP) for simultaneous saccharification and fermentation |

| TRL 3-4 | Early Development | Potential demonstrated in laboratory settings, requiring further refinement. | 3rd generation bioethanol from algae, Microbial fermentation using non-conventional feedstocks |

| TRL 1-2 | Fundamental Research | The research focused on exploring the potential of new feedstocks and conversion pathways. | Direct conversion of lignocellulose to bioethanol, Cellulosic bioethanol production using engineered microorganisms |

End-Use Applications of Bioethanol

| Category | Application | Description |

| Transportation | Gasoline Blending (E5-E20) | The primary application, replace a portion of gasoline, reducing harmful emissions and dependence on fossil fuels. |

| E85 and E100 (Flex-Fuel Vehicles) | Higher ethanol blends (E85: 85% ethanol, E100: pure ethanol) are used in specially designed vehicles for cleaner burning. | |

| Industrial Applications | Chemical Feedstock | Renewable alternative to petroleum-derived feedstock for producing various chemicals like ethylene (used in plastics, polyester, etc.). |

| Solvents and Cleaning Agents | Leverages solvent properties for use in cleaning solutions, degreasers, and disinfectants. | |

| Paints and Coatings | Bio-based solvent option in some paints and coatings, contributing to sustainable product formulation. | |

| Energy Generation | Bioethanol Fuel Cells | Utilizes bioethanol in fuel cells for electricity generation (still under development). |

| Combined Heat and Power (CHP) | Co-generates electricity and heat, maximizing energy efficiency and reducing reliance on fossil fuels for power. | |

| Other Applications | Cooking Fuel | Clean and efficient cooking fuel option, particularly in rural areas. |

| Biogas Production | Feedstock for biogas production through anaerobic digestion. Biogas can then be used for various purposes like power generation or vehicle fuel. |

Additional Applications of Bioethanol

Potential Future Uses

| Category | Application | Description |

| Aviation Fuel | Bioethanol Blends in Sustainable Aviation Fuel (SAF) | Research and development are ongoing to explore bioethanol as a potential component in SAF blends, aiming to reduce the carbon footprint of the aviation industry. |

| Marine Biofuels | Bioethanol Blends in Marine Fuels | Similar to aviation, bioethanol blends are being investigated for reducing emissions in the maritime sector. Challenges like fuel stability and engine compatibility are being addressed. |

| Hydrogen Production | Bioethanol as a Feedstock for Biohydrogen Production | Bioethanol can be used as a renewable feedstock for producing hydrogen through various processes like steam reforming or fermentation. Bio-hydrogen has applications in fuel cells and other clean energy technologies. |

Niche Applications

| Category | Application | Description |

| Pharmaceutical Industry | Bioethanol as a Solvent and Excipient | Bioethanol can be used as a solvent in various pharmaceutical processes and can also function as an excipient in some drug formulations. |

| Personal Care Products | Bioethanol as a Solvent and Ingredient | In some cases, bioethanol finds use as a solvent in personal care products like cosmetics and fragrances. It can also be an ingredient in certain formulations. |

| Biodegradable Plastics | Feedstock for Bio-based PEF (Polyethylene Furanoate) | Bioethanol can be a potential feedstock for producing bio-based PEF, a type of biodegradable plastic with potential applications in packaging and other sectors. |

Sectors Benefiting from Bioethanol

| Sector | Benefits |

| Transportation | Reduced reliance on fossil fuels, Lower greenhouse gas emissions, Improved air quality |

| Agriculture | Creation of new markets for crops, Increased demand for agricultural equipment and services |

| Chemical and Manufacturing | Production of bio-based products, Development of new technologies |

| Environmental | Reduced air and water pollution, Carbon sequestration (with specific feedstock) |

Sectors benefiting from bioethanol indirectly

| Rural Development | Creation of employment opportunities in rural areas, particularly in feedstock cultivation, processing, and transportation. |

| Energy Security | Contributes to diversification of energy sources, reducing dependence on single fuel sources and geopolitical uncertainties. |

| Waste Management | Enables utilization of organic waste streams like agricultural residues for bioethanol production, promoting waste diversion and circular economy principles. |

| Research and Development | Drives innovation and investment in new technologies for efficient and sustainable bioethanol production, feedstock development, and conversion processes. |

Key Challenges in the Bioethanol Sector in India

Despite the potential benefits of bioethanol, several key challenges hinder its widespread adoption and sustainable development in India.

Feedstock Availability and Cost

- Limited Feedstock Options: Currently, bioethanol production in India relies heavily on sugarcane molasses, creating dependence on a single feedstock and potential competition with food production.

- Seasonality and Geographical Variations: The availability of agricultural residues and other potential feedstocks can vary significantly depending on the season and geographical location, posing logistical and economic challenges.

- High Feedstock Costs: The cost of acquiring and transporting feedstocks can be a significant contributor to the overall production cost of bioethanol, making it less competitive with fossil fuels.

Technological Challenges

- Development of 2G Bioethanol Technology: While promising, 2G bioethanol technology is still under development, and commercially viable and efficient production processes need further refinement.

- High Capital Costs: Setting up bioethanol plants, especially those utilizing 2G technologies, requires significant upfront investments, making it a barrier to entry for smaller players.

Policy and Regulatory Frameworks

- Uncertainty in Policy Implementation: Frequent changes or delays in implementing biofuel policies can create uncertainties and discourage long-term investments in the sector.

- Inadequate Price Incentives: Current pricing mechanisms for bioethanol might not be sufficient to ensure economic viability and attract investments in advanced technologies.

- Land Availability and Regulations: Land acquisition for bioethanol production can be challenging due to complex regulations and competition from other land uses.

Sustainability Concerns

- Indirect Land Use Change (ILUC): Concerns exist regarding potential indirect land-use change, where increased demand for bioethanol feedstocks could lead to the conversion of forests or natural ecosystems, negating environmental benefits.

- Water Consumption: Bioethanol production can be water-intensive, especially for certain feedstocks and processes. Sustainable water management strategies are crucial to minimize environmental impact.

Other Challenges

- Limited Infrastructure: The infrastructure required for efficient collection, transportation, and storage of diverse feedstocks needs further development.

- Lack of Awareness and Public Perception: There’s a need for increased awareness and education among stakeholders, including farmers and consumers, to address concerns and promote wider acceptance of bioethanol.

One of the key challenges of the Indian bioethanol industry is securing a consistent supply of feedstock while balancing its use in food and fuel sectors.Despite these challenges, the bioethanol market offers lucrative opportunities for investors, with growing interest in second-generation biofuels

Government Policies

Key Regulatory Policies

- National Biofuel Policy: The overarching framework governing India’s biofuel sector, including bioethanol. It sets ambitious targets for blending biofuels with conventional fuels and outlines a roadmap for achieving them. Revisions to the policy offer clarity and support for the sector.

- Ethanol Blended Petrol (EBP) Program: Mandates the blending of ethanol with gasoline/petrol to reduce reliance on oil imports and lower emissions. It has seen increasing blend targets up to the current 20% by 2025/2026.

- Pradhan Mantri JI-VAN Yojana: Supports the establishment of commercially viable integrated bioethanol projects, focusing on 2G technology and utilizing waste and cellulosic biomass.

Incentives and Schemes

- Financial Support: The government offers various financial incentives for setting up bioethanol production units, including capital subsidies, interest subsidies, and viability gap funding for select projects.

- Excise Duty Benefits: Reduced or zero excise duty on bioethanol for blending with petrol provides a cost advantage and market incentive.

- Assured Offtake Agreements: Oil Marketing Companies (OMCs) assure the purchase of ethanol produced from approved projects, providing market security to producers.

- Tax Concessions: Some states provide tax concessions on the sale of bioethanol to encourage its adoption.

- State-level Policies: Several states have their biofuel policies and incentives, which may vary, adding a layer of complexity but also opportunities for localized support.

- Feedstock Availability: Regulations and incentives are designed to promote the use of non-food crops and waste residues for sustainable bioethanol production.

- Quality Control: The Bureau of Indian Standards (BIS) sets quality standards for ethanol to ensure compatibility and engine performance.

Business Models for the Indian Bioethanol Sector

| Model | Description | Benefits (Farmers) | Benefits (Companies) | Risks (Farmers) | Risks (Industries) |

| Contract Farming | Companies provide seeds, assistance, and guaranteed buyback in exchange for cultivated crops. | Secure market and income, access to expertise. | Reliable feedstock supply, and quality control. | Dependence on a single buyer, the potential for contract disputes. | Managing contract enforcement, the potential for crop failure impacting supply. |

| Partnerships with Biofuel Companies | Farmers/cooperatives collaborate with biofuel companies to share resources and risks. | Shared risks and benefits, knowledge transfer. | Access to reliable feedstock, and collaboration with experienced growers. | Dependence on larger companies, unequal bargaining power. | Sharing profits, the potential for disputes with partners. |

| Integrated Biorefinery | Large companies establish their facilities encompassing the entire value chain. | Greater control over the process, potentially higher profits. | High upfront investment, diverse expertise needed, potential environmental/social impact if not managed sustainably. | N/A | N/A |

Key Stakeholders and Companies in this Ecosystem

Feedstock Suppliers

- Sugarcane Mills

- Bajaj Hindusthan Sugar Ltd.: Largest sugar and ethanol producer in India, focusing on sugarcane-based 1G ethanol. (Website: https://www.bhsl.com/)

- Shree Renuka Sugars Ltd.: Global agri-business conglomerate with a strong presence in sugarcane milling and ethanol production.

- Balrampur Chini Mills Ltd.: Leading sugar and ethanol producer in north India, committed to expanding its biofuel capacity.

- Non-Food Feedstock Players

- Praj Industries: Leading manufacturer of bioethanol plants, also exploring cellulosic ethanol technologies. (Website: https://www.prajindustries.com/)

- Triveni Engineering & Industries Ltd.: Diversified engineering company with operations in sugar and bioethanol production. (Website: https://www.trivenigroup.com/)

- Indian Institute of Chemical Technology (IICT): Government research institute focusing on developing technologies for cellulosic ethanol production from agricultural residues. (Website: https://www.iictindia.org/)

3. Technology Providers

- Biocon Ltd.: Leading biotechnology company involved in enzyme development and fermentation technologies for biofuels. (Website: https://www.biocon.com/)

- Thermax Ltd.: Provides bioethanol and biogas production plants, along with related technologies and services. (Website: https://www.thermaxglobal.com/)

- CSIR-National Chemical Laboratory (NCL): Government research laboratory with expertise in biofuel technologies like enzymatic hydrolysis and fermentation. (Website: https://www.ncl-india.org/)

4. Producers and Refiners

- Established Producers

- BPCL Biofuels Ltd.: Joint venture between BPCL and Maharashtra State Sugar Federation, focused on ethanol production from sugarcane molasses.

- HPCL Biofuels Ltd.: Subsidiary of Hindustan Petroleum Corporation Limited (HPCL) involved in ethanol production and blending.

- EID Parry (India) Ltd.: Leading sugar and ethanol producer with a strong presence in south India. (Website: https://www.eidparry.com/)

- Oil Companies with Bioethanol Investments

- Indian Oil Corporation Ltd. (IOCL): Exploring bioethanol production through joint ventures and partnerships. (Website: https://www.iocl.com/)

- Bharat Petroleum Corporation Ltd. (BPCL): Partnering with BPCL Biofuels for ethanol production and investing in advanced biofuels research.

Strategic Initiatives of Indian Industries

| Initiative | Description | Benefits/Goals | Examples |

| Capacity Expansion | Establishing new dedicated bioethanol plants and expanding existing capacities | Increase bioethanol production, meet blending mandates | – Balrampur Chini Mills’ expansion plans for bioethanol production |

| Diversification of Feedstocks | Moving beyond sugarcane molasses towards alternative feedstocks like damaged grains, maize, sorghum, cassava, and agricultural residues | Reduce dependence on sugarcane, utilize diverse feedstock options, address sustainability concerns | – Hindustan Petroleum Corporation Limited (HPCL) exploring maize and sorghum for bioethanol production |

| Strategic Collaborations | Forming joint ventures, partnering with technology providers, and collaborating with research institutions | Pool resources and expertise, access advanced technologies, accelerate research and development | – Praj Industries collaborating with international companies for advanced bioethanol production processes |

| Technology Development and Adoption | Investing in research and development, adopting and adapting advanced technologies for bioethanol production from diverse feedstocks | Improve production efficiency, enhance conversion rates, reduce production costs | – Establishment of pilot and demonstration plants for 2G bioethanol production |

| Skill Development and Training | Providing training and skill development programs for the workforce engaged in the bioethanol sector | Enhance workforce capacity, ensure availability of skilled personnel for the growing industry | – Collaborations between industries and vocational training institutions |

Conclusion

The Indian bioethanol market is poised for substantial growth, driven by the government’s aggressive ethanol blending mandate and the increasing demand for sustainable energy solutions. With an estimated market size of USD 5.2 billion by 2027 and a projected capacity expansion to 15 billion liters by 2030, the bioethanol industry is strategically positioned to contribute significantly to India’s energy portfolio. The adoption of diverse feedstocks, including molasses, starch-based feedstocks, and emerging lignocellulosic biomass, ensures a robust and versatile supply chain, enhancing the sector’s resilience and sustainability.

Future growth in the bioethanol sector will hinge on continued government support, technological advancements in second-generation bioethanol production, and the exploration of new feedstock sources. Companies like Praj Industries and Balrampur Chini Mills Ltd. are leading the charge, leveraging their expertise to expand production capacities and develop innovative solutions. The bioethanol market in India is poised for robust growth, playing a crucial role in the country’s renewable energy ambitions. With strong government backing and advancements in bioethanol production technology, the industry is set to be a cornerstone of India’s sustainable energy future.

Expert Consulting Assistance for Indian Bioenergy & Biomaterials

Talk to BioBiz

Call Muthu – 9952910083

Email – ask@biobiz.in